Conestoga Mid Cap Growth

Overview

Strategy Investment Approach (as of 12/31/24)

Benchmark

Overview

Total Strategy Assets (as of 12/31/24)

Benchmark

Strategy Objective

The Strategy seeks to provide long-term growth of capital.

Strategy Investment Approach

The Strategy strives to generate long-term investment returns favorable to its benchmarks with lower risk. The Strategy typically holds 30-45 mid capitalization stocks that the investment team believes are attractively valued relative to their growth prospects. Conestoga seeks companies which we believe have sustainable earnings growth rates, high returns on equity, low debt levels, and capable management teams.

Performance

Total Returns vs. Benchmark

| QTD | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception (3/31/2010) | |

|---|---|---|---|---|---|---|---|

| Conestoga Mid Cap Composite (Net) | -4.63% | 4.36% | 4.36% | -3.39% | 6.84% | 10.63% | 11.30% |

| Russell Midcap Growth Index | 8.14% | 22.10% | 22.10% | 4.04% | 11.47% | 11.54% | 12.98% |

All periods greater than one year are annualized. Past performance does not guarantee future results. Current performance may be lower or higher than the performance quoted. Performance data includes reinvestment of dividends. Investment returns and principal value of an investment will fluctuate. The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price/book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000® Growth Index. Please see additional important disclosures in the fully compliant GIPS presentation at the bottom of this page.

Portfolio

Sector Weightings

Source: FactSet Research Systems and Conestoga Capital Advisors. Sectors are defined according to the ICB industry classifications.

Strategy Facts

| Conestoga Mid Cap Composite | Russell Midcap Growth Index | |

| P/E (1 Yr. Forward incl. Neg.) | 34.1x | 25.7x |

| Earnings Growth (3-5 Yr.) | 10.4% | 17.6% |

| Weighted Avg. Market Cap. | $28,086.7 Mil | $38,824.2 Mil |

| ROE (5 Yr. Weighted Avg.) | 21.6% | 14.2% |

| Long-Term Debt/Capital | 37.4% | 48.0% |

| Turnover Rate | 6.06% | N/A |

| Number of Holdings | 34 | 290 |

P/E (1 Yr Fwd) is the ratio of a stock’s price to forecasted earnings over the next year. Earnings growth is the forecasted growth rate of a company’s earnings over the next 3-5 years. PEG Ratio represents the ratio of P/E over Earnings Growth rate, and is a widely used valuation metric. ROE—Five Year Average is calculated as a company’s net income divided by its shareholders’ equity, and is a measure of profitability. Long-Term Debt/ Capital is a measure of how much debt a company is using to finance its operations, and is determined by dividing long-term debt by total capitalization. Forecasted data is sourced from FactSet Research Systems and represents the average of sell-side analyst forecasts.

Top Ten Equity Holdings

| 1. Copart, Inc. | 4.96% |

| 2. HEICO Corp. | 4.92% |

| 3. Verisk Analytics, Inc. | 4.91% |

| 4. Rollins, Inc. | 4.87% |

| 5. Tyler Technologies, Inc. | 4.74% |

| 6. Waste Connections, Inc. | 4.63% |

| 7. Gartner, Inc. | 4.13% |

| 8. Fortinet, Inc. | 4.11% |

| 9. Roper Technologies, Inc. | 3.63% |

| 10. West Pharmaceutical Services, Inc. | 3.45% |

| Total Percentage of Portfolio | 44.35% |

The positions represent Conestoga Capital Advisors largest equity holdings based on the aggregate dollar value of positions held in the client accounts that are included in the Mid Cap Composite. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Sectors are defined according to the ICB industry definitions.

Portfolio Management Team

Disclosures

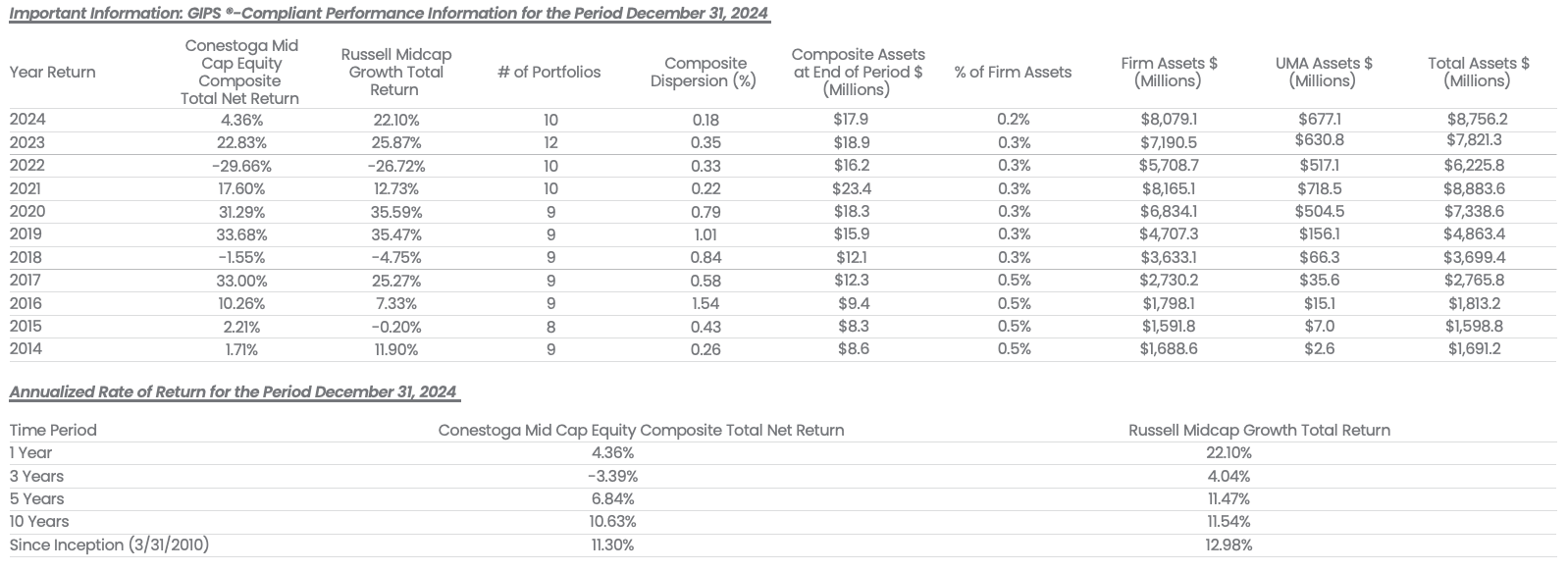

Conestoga Capital Advisors, LLC claims compliance with the Global Investment Performance Standards (GIPS) and has prepared and presented this report in compliance with the GIPS standards. Conestoga Capital Advisors, LLC has been independently verified for the periods December 31, 1998 through March 31, 2024 by independent verifiers.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Conestoga Mid Cap Equity Composite (“Composite”) has had a performance examination for the periods March 10, 2010 through March 31, 2024. The verification and performance examination reports are available upon request.

A complete list and description of all composites and policies for valuing portfolios, calculating and reporting returns, and preparing GIPS reports are available upon request. Performance results are presented after all actual investment management fees, custodial fees, commissions, and other trading expenses. Computations assume the reinvestment of all dividends and capital gains. Portfolios are valued monthly, and returns are weighted by using beginning-of-quarter values plus weighted cash flows. Annual returns are calculated by geometrically linking the monthly returns. Performance results for the full historical period are total net return, time-weighted rates of return expressed in U.S. dollars. Trade date accounting is used for all periods. No leverage has been used in the accounts included in the Composite. The actual return and value of an account will fluctuate and at any point could be worth more or less than the amount invested. Individual account performance will vary according to individual investment objectives.

All fee-paying discretionary portfolios will be assigned to an appropriate composite according to investment objective. Composites will include new portfolios at the start of the next performance measurement period (i.e. the beginning of the next month) after the portfolio comes under management and will exclude terminated portfolios after the last full calendar month period the portfolios were under management (i.e., the end of the last full calendar month), but composites will continue to include terminated portfolios for all periods prior to termination.

The benchmark for this composite is the Russell Mid Cap Growth Index, which measures the performance of those Russell Midcap companies with higher price/book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000® Growth Index. Index returns are provided for comparison purposes to represent the investment environment existing during the time periods shown. An index is fully invested, includes the reinvestment of dividends and capital gains, but does not include any transaction costs, management fees, or other costs. Holdings of each separately managed account in a composite will differ from the index. An investor may not invest directly in an index. (Source: Russell)

UMA assets presented are not part of Conestoga’s GIPS-defined firm assets as Conestoga has no trading authority over these assets and serves in an advisory-only capacity. UMA assets under management are received on a preliminary quarterly basis, which are subject to change by the plan sponsor after a complete reconciliation of the underlying accounts. The “Total Assets” include UMA assets and are not part of the GIPS firm assets. UMA and Total Assets are shown as supplemental information.

The current management fee schedule is as follows: Up to $25,000,000 = 1.00%; Over $25,000,000 = Negotiable.

The dispersion of annual returns is measured by the standard deviation across equal-weighted portfolio returns represented within the Composite for the full year. Dispersion is shown as “N/A” for periods less than one year and for periods with 5 or fewer composite members for the entire year.

As of December 31, 2024, the three-year standard deviation, calculated net of fees, for the Conestoga Small Cap Equity Composite was 21.77% and the Russell 2000 Growth was 23.99%. As of December 31, 2023, the three-year standard deviation, calculated net of fees, for the Conestoga Small Cap Equity Composite was 19.87% and the Russell 2000 Growth was 21.79%. As of December 31, 2022, the three-year standard deviation, calculated net of fees, for the Conestoga Small Cap Equity Composite was 22.47% and the Russell 2000 Growth was 26.20%.

Conestoga Capital Advisors, LLC is an independent registered investment advisory firm specializing in small and mid cap portfolio management. The Conestoga Mid Cap Equity Composite creation date and inception date is March 31, 2010. This Composite contains fee-paying, discretionary portfolios which primarily invest in Mid Cap equities. For an account to be included in the Composite, no more than 20% of the assets can have a market capitalization outside the size range of the Russell Mid Cap Index at the time of initial purchase. All portfolios have more than $250,000 in assets. Mutual funds and model-based non-discretionary portfolios are excluded from the Composite. As of June 18, 2021, the Composite definition was redefined. Previously, the market capitalization size range was calculated using a rolling 3-year average of the Russell Mid Cap Growth Index. Portfolios will not be removed from the assigned composite if they fall below the minimum simply due to market depreciation. Past performance is not indicative of future results.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.